Corporate Governance

Concept and System

Based on our group management principle of "Always Putting the Customers First," we are committed to fulfilling our corporate social responsibility in order to achieve sustainable growth and increase corporate value, in cooperation with the government, local communities, consumers, shareholders, retailers, suppliers, sales partners, financial institutions, employees, and other stakeholders, and will make it a fundamental approach to support corporate governance. As a "Health Creation Company" that contributes to the health of customers around the world, we will work to further strengthen and enhance our corporate governance system to realize our long-term vision of becoming a "Global Tea Company".

System

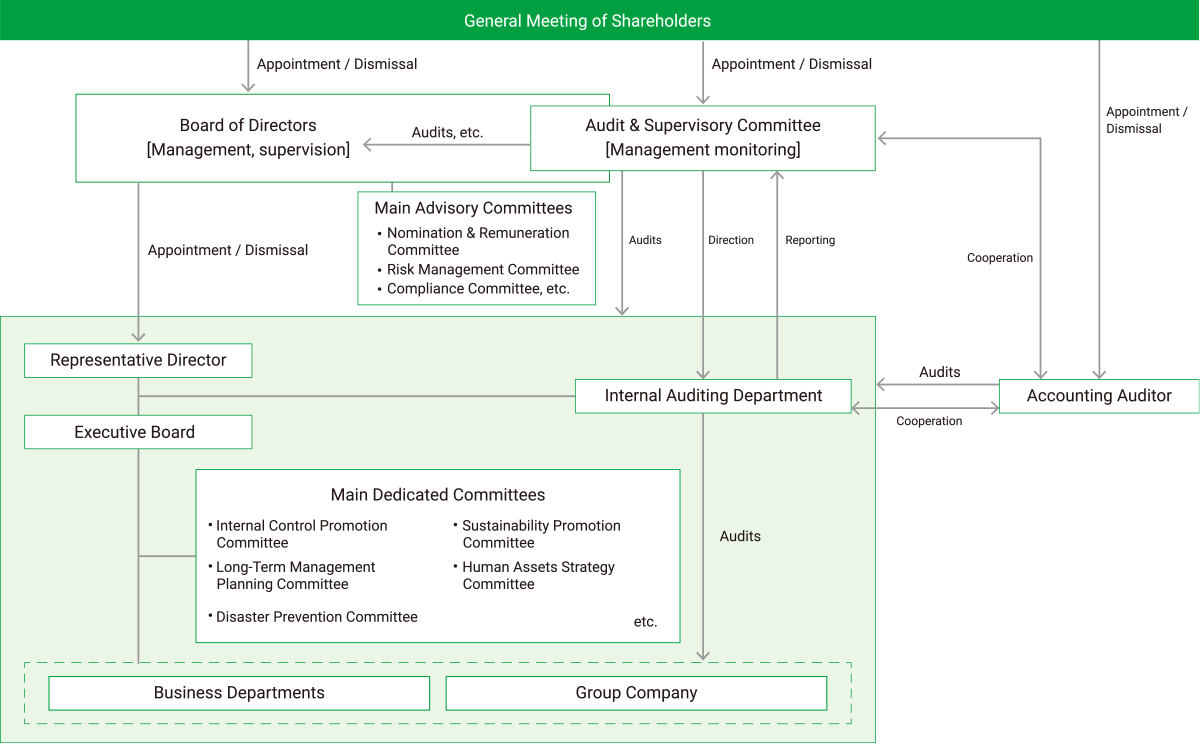

Corporate Governance Structure

System overview (since July 26, 2024 )

| Organization Form | Company with Audit & Supervisory Committee |

|---|---|

| Number of Directors | 13(of which Outside Directors: 5) |

| Number of Independent Directors | 5 |

| State of Voluntary Establishment of Committees | Nomination & Remuneration Committee |

| Accounting Auditor | KPMG AZSA LLC |

Board of Directors

The Articles of Incorporation stipulate that the maximum number of Directors(excluding Directors who are Audit and Supervisory Committee Members) shall be 11 and the maximum number of Audit and Supervisory Committee Members shall be 4. To enhance the Board of Directors’ supervisory functions, Independent Outside Directors shall be a third or more of all Directors. The Board of Directors shall have, as a whole, a balanced set of knowledge, experience and skills in accordance with management strategies, etc. to effectively fulfill its roles and responsibilities. The Board shall have an appropriate number of members who are diverse in terms of gender, internationality, career history, age, and other attributes.

Audit & Supervisory Committee

The Articles of Incorporation stipulate that the number of Audit and Supervisory Committee members shall be three or more, but not more than the number stipulated in the Articles of Incorporation, and that the majority shall be Outside Directors. The Audit and Supervisory Committee shall select a full-time Audit and Supervisory Committee member from among the Directors who are Audit and Supervisory Committee members. One or more Audit & Supervisory Committee Members shall have appropriate experience and skills and necessary knowledge regarding finance, accounting and legal affairs, in particular, considerable knowledge regarding finance and accounting.

Reasons for electing Outside Directors and Outside Audit & Supervisory Committee Members

| Hideo Takano | Mr. Hideo Takano has deeply participated in business support for a variety of companies at the Tokyo Chamber of Commerce and Industry for many years. Leveraging his extensive experience and broad insight, he has provided opinions, advice, and proposals that contribute to the enhancement of the ITO EN Group’s corporate value, from a standpoint independent of the Board of Directors and the management of the Company. Based on these accomplishments and his wealth of experience, we have elected him as an Outside Director in the expectation that he will continue to provide advice and effective supervision of the Group's management. Because the appointment of Mr. Takano does not fall under the matters which the Tokyo Stock Exchange defines as those that could give rise to conflicts of interest with general shareholders, he is independent from the Company. |

|---|---|

| Keiko Abe | Ms. Keiko Abe has extensive experience and expert knowledge as a professor of the University of Tokyo’s Graduate School of Agricultural and Life Sciences and has been actively involved in research in the field of food functionality for many years. The Company newly appointed her as Outside Director because it has determined that she is able to provide useful advice in the field of research and development related to future medium- to long-term management based on her extensive experience and knowledge. Because the appointment of Ms. Abe does not fall under the matters which the Tokyo Stock Exchange defines as those that could give rise to conflicts of interest with general shareholders, she is independent from the Company. |

| Yuichi Usui | Mr. Yuichi Usui has considerable experience and a wide range of insight as a police officer for many years and also has experience in being directly involved in company management in a logistics company. He applies his diverse experience and insight to the Company's management, provides a broad Based on these accomplishments and his wealth of experience, we have elected him as an outside director so that he can continue to provide risk-related advice and conduct highly effective audits of the Company's management, drawing on his experience as a corporate executive as well. Because the appointment of Mr. Usui does not fall under the matters which the Tokyo Stock Exchange defines as those that could give rise to conflicts of interest with general shareholders, he is independent from the Company. |

| Hitoshi Yokokura | Mr. Hitoshi Yokokura has expertise and a wide range of knowledge and experience as a certified public accountant and lawyer. As an Outside corporate Auditor, he mainly audits the legality of the execution of duties by directors and provides advice and recommendations as appropriate. Based on these accomplishments and his wealth of experience, he is appointed as an outside director so that he can continue to make suggestions from an accounting and legal perspective and conduct highly effective audits of the Company's management. Because the appointment of Mr. Yokokura does not fall under the matters which the Tokyo Stock Exchange defines as those that could give rise to conflicts of interest with general shareholders, he is independent from the Company. |

| Yoshihiko Okuda | Mr. Yoshihiko Okuda has expertise and a wide range of knowledge and experience as a licensed tax accountant. We have elected him as an Outside Director so that he can provide advice and conduct highly effective audits of the Company’s management based on his extensive experience and expertise. Because the appointment of Mr. Okuda does not fall under the matters which the Tokyo Stock Exchange defines as those that could give rise to conflicts of interest with general shareholders, he is independent from the Company. |

Nomination & Remuneration Committee

The Company has established the Nomination & Remuneration Committee to enhance the independence and objectivity of the functions of the Board of Directors and its accountability through the appropriate involvement and consultation of Independent Outside Directors on particularly important matters related to corporate governance such as the nomination and remuneration of Directors and others. The Nomination & Remuneration Committee shall be composed of three or more Directors including Outside Directors as members and shall consist of a majority of Independent Outside Directors. Members shall be elected by resolution of the Board of Directors, and the chairperson shall be elected from among the members who are Independent Outside Directors by resolution of the Nomination & Remuneration Committee.

The Nomination & Remuneration Committee shall deliberate on the following matters as an advisory body to Board of Directors and submit a report to the Board of Directors.

1. Policy concerning composition of the Board of Directors

2. Matters relating to the election and dismissal of Directors, executive officers, and the proposal of candidates for Directors, executive officers

3. Matters relating to proposals for the election or dismissal of Representative Directors, and Directors and executive officers with special titles

4. Matters relating to president succession planning

5. Matters relating to the remuneration limit, remuneration system and remuneration amount for Directors and executive officers

6. Matters relating to the personnel affairs and remuneration of officers of major subsidiaries and affiliated companies

7. Other matters relating to corporate governance

Composition of Committees

-

- Chairperson

- Director(Outside), Audit and Supervisory Committee Member Yuichi Usui

-

- Member

- Director(Outside) Keiko Abe

-

- Member

- Director(Outside), Audit and Supervisory Committee Member Hitoshi Yokokura

-

- Member

- President, Director Daisuke Honjo

-

- Member

- Vice-President, Director Shusuke Honjo

Evaluation of the Effectiveness of the Board of Directors

The Company has been analyzing and evaluating the effectiveness of the Board of Directors every year since FY2015, in an effort to improve its functioning.

Evaluation method in FY2023

Self-assessment by questionnaire

Individual interviews based on the results of the questionnaire

Tabulation and analysis of questionnaire and interview results

Evaluation items in FY2023

1. Size and makeup of the Board of Directors

2. Discussions of the Board of Directors

3. State of operation of the Board of Directors

4. Relationship with shareholders

5. Structure of, deliberations at, etc. of Nomination & Remuneration Committee

6. Self-assessment

Results of evaluation in FY2023

The size and operation of the Board of Directors have been confirmed to be sufficient to fulfill its management decision-making and supervisory functions. While improvements have been made regarding the composition of the Board, it has been confirmed that continued efforts are necessary to further enhance diversity. It has also been confirmed that discussions are continuing to take place in a free and constructive atmosphere, where members can speak freely and actively participate.

On the other hand, it has been pointed out that ensuring discussions and regular progress reports regarding medium- to long-term management strategies from ESG and other sustainability perspectives, as well as sharing and actively discussing the execution status, etc. of both domestic and overseas group companies in their efforts to become a “Global Tea Company” are necessary.

Going forward, the Company will seek to improve the effectiveness of the Board of Directors by continuing working to solve issues.

Remuneration for Corporate Officers

Remuneration, etc. of Directors is deliberated by the Nomination & Remuneration Committee, which consists of a majority of Independent Outside Directors, to ensure objectivity and transparency in accordance with the Company’s basic views on corporate governance and basic views on remuneration. The Board of Directors determines the remuneration, etc. of Directors, giving due respect to the report by the Nomination & Remuneration Committee. Remuneration, etc. for directors, distinguishing between those who are members of the Audit and Supervisory Committee and those who are not, shall be determined within the limit of remuneration resolved at the General Meeting of Shareholders. The Nomination & Remuneration Committee deliberates on the individual remuneration, etc. of Directors, including whether it is consistent with the basic policy and whether it has been evaluated based on the remuneration standards, and the Board of Directors shall determine the individual remuneration, etc. of Directors by respecting the report by the Nomination & Remuneration Committee.

Basic policy

1. Remuneration shall be such that it is in compliance with the management principle of the ITO EN Group, “Always Putting the Customer First,” and will contribute to sustained corporate growth and development and the enhancement of corporate value.

2. Remuneration shall be determined in proportion to the significance of Directors’ roles and responsibilities and their contribution to the Company’s business performance.

3. Remuneration shall be closely linked to the sharevalue price of the Company’s stock, so that Directors share the impact of share price fluctuations with the Company’s shareholders and the remuneration serves as an incentive for management.

4. Remuneration shall be determined based on objective and fair deliberations and with references to external data.

Executive remuneration amounts

Remuneration, etc. of Directors (excluding Outside Directors and Directors who are Audit and Supervisory Committee Members) of the Company shall comprises fixed remuneration and variable remuneration, withfixed remuneration comprising approximately 65% and variableremuneration approximately 35%. (approximately 20% of performance-based remuneration and approximately 15% of share-based remuneration) Remuneration, etc. for Outside Directors and Directors who are Audit and Supervisory Committee Members shall be fixed remuneration only.

Fixed remunerations

Fixed remuneration shall be the basic reward paid in cash according to the position and role, and shall be paid monthly in principle.

Variable remuneration

Performance-linked remuneration is a monetary remuneration determined based on the evaluation of performance during the evaluation period and, in principle, shall be paid monthly.

The stock-based compensation shall be a restricted stock compensation plan that allocates shares of the Company's common stock once a year to each director and executive officer in accordance with position and role during the term of office, for the purpose of increasing the level of interest in the Company's stock price and business performance and further enhancing motivation and morale to increase the stock price and improve business performance by linking stock price to that of the Company and by placing in a position to share the value with shareholders in terms of the impact of stock price fluctuations.

- (1) Evaluation of variable remuneration

- The Company shall perform a comprehensive performance assessment in which, in order to link the business performance and remuneration, the Company designates management indicators as measures of performance, sets the standard ratio of consolidated performance to non-consolidated performance for each position, considers each Director’s responsibilities, and awards points to each Director with respect to each management indicator.

- (2) Management indicators used to measure performance

- The Company’s management indicators used to measure performance shall include “net sales (growth),” “operating income (profitability),” “cash flows from operating activities (stability),” “earnings per share (profitability),” “return on equity (efficiency)” and “dividend on equity ratio (shareholder return),” “ESG external evaluation results.”

Internal Control System

Basic views

Based on our management philosophy of "Always Putting the Customer First," we have adopted a basic policy on internal control systems at a meeting of the Board of Directors in order to increase the transparency of our business operations and further improve the effectiveness and efficiency of our group's internal management systems, in line with the interests of all our stakeholders and to earn their trust.

Operation of internal control system

The Internal Auditing Department, which reports directly to the President and Executive Officer and is independent of other administrative and operational departments, conducts audits of the internal control system. The results of these audits are discussed at the Internal Control Promotion Committee, chaired by the director in charge of internal control, and are resolved in the Internal Control Report at the Board of Directors meeting.

In addition, the Compliance Section of the Legal Department and the Internal Auditing Department strive to raise awareness of compliance with a wide range of laws and regulations, social norms, and corporate ethics, check the appropriateness of business operations, provide ongoing compliance education, and make timely improvements to operations that are not fully in place.

Moreover, the Company tries to operate the internal control system by adopting a system to report important matters to the Board of Directors or the Executive Board.

Risk management system

- (1) To develop the risk management system, the Company establishes Risk Management Regulations and has a Risk Management Committee chaired by the President and Executive Officer.

- (2) The Risk Management Committee shall ascertain the status of risk information and responses of the Group, and report to the Board of Directors on the identification and evaluation of significant risks and responses to avoidance, reduction, etc. of such risks.

- (3) The Company shall establish committees, etc., for each risk area, such as compliance, sustainability, quality, disaster countermeasures, etc., and establish a system to coordinate with the Risk Management Committee.

- (4) The Company has developed a system to minimize damages when an unforeseen situation occurs by establishing a task force headed by the Representative Director and President to prevent the expansion of damages by taking prompt measures.

Intellectual Property

Intellectual property system

In accordance with its intellectual property policy and important strategies defined in the medium-term management plan, the Company promotes intellectual property management that contributes to solving social issues and improving corporate value. The Company has an Intellectual Property Department dedicated to handling intellectual property matters, with the support of external consulting experts. Moreover, the Intellectual Property Department staff are stationed at the Production Headquarters in Shizuoka prefecture, ensuring a system that proactively provides support to the R&D Department.

In cooperation with each department, the Intellectual Property Department provides support for strategies for research and development and brand and intellectual property-related education. Moreover, the Intellectual Property Department began IP Landscape activities last year and provides recommendations at research and development strategy meetings and business planning meetings. Details of these activities and the risk management issues related to intellectual property are reported by the executive officers in charge to the Board of Directors, and feedback is obtained.

Support for management strategies

ITO EN Group mission of being a Health Creation Company

As the Health Creation Company, the Group provides unique products that have significant health value and contributes to customers’ healthy living through its support for research and development concerning the functionality of food, including the impact of green tea and matcha on cognitive functions, through its intellectual property activities.

Long-term vision of becoming a Global Tea Company

Towards the realization of a “Global Tea Company,” our core tea-related business secures supply chainoriented intellectual property rights from tea plantations and tea products to recycling of used tea leaves.

In the technology field of tea (International Patent Classification: A23F3), the percentage of our patents in the top 5% of citations in the same technology category is approximately 11%. Our intellectual property rights related to our proprietary technologies and products give us a competitive advantage and enable us to provide products that meet the diverse needs of our customers. The Company is also helping tackle environmental and social issues through its business activities by implementing a recycling-oriented business model based on intellectual property rights, including the recycling of used tea leaves, less pesticide/organic farming, and sustainable containers and packaging.

Aiming to strengthen our overseas business, the Company has been promoting the appropriate and effective acquisition of intellectual property rights while gathering data on intellectual property globally to secure such rights and avoid intellectual property risks worldwide.

Investment for the development of human resources and encouragement of innovation

The Company’s growth has been driven by a range of innovations, such as the creation of beverages from unsweetened tea which had previously been considered impossible. Innovation is the Company’s source of growth. The Intellectual Property Department conducts training tailored to the needs and proficiency levels of various departments involved in the creation of intellectual property, such as the R&D, marketing, and manufacturing departments, fostering a foundation for intellectual property creation and promoting innovation. In fiscal year 2023, intellectual property training was provided to 159 employees (of which 27 are involved in the overseas business) in departments engaged in intellectual property creation, bringing the cumulative number of internal inventors who have created intellectual property to 159 as of end of April 2024.

We are also working to protect and utilize the intellectual property rights of the ITO EN Group by promoting intellectual property creation and rights acquisition in cooperation with the relevant departments of the Group companies.

On the institutional side, we have in place an Invention Compensation System, and in fiscal year 2023, 151 compensation payments were made during the year. Through the operation of this system, we encourage the creation of intellectual property by our employees and work to contribute to the business development.

Appropriate tax management

The ITO EN Group complies with laws and regulations both in Japan and overseas and ensures the development and appropriate application of internal rules based on the Group management principle of "Always Putting the Customer First." The Group also seeks to comply with tax-related laws and regulations both in Japan and overseas and to properly file tax returns and pay taxes in accordance with legal requirements.

Furthermore, by ensuring tax transparency and reliably meeting its tax obligations in a timely and appropriate manner, the Group contributes to the economic and social development of all the countries and regions in which it operates.

Information disclosure system

Fundamental Approach

The Company has established the Inside Information Management Regulations for the purpose of preventing insider trading that violates the Financial Instruments and Exchange Act by setting management standards and other rules for inside information.

Based on the Inside Information Management Regulations, the Company has built a system to report and disclose facts about changes in the operation, business and assets of the Company and facts that could have a significant impact on the investment decisions of investors.

System